Unpacking the parts of Medicare: Parts A, B, C, D and Medicare Supplement plans

Knowing the parts of Medicare is the first step towards learning how to get the most out of your health care coverage.

If life is a journey, then you’ll want to pack for the trip. Medicare, the government-sponsored health insurance program for people 65 and over (and those with certain disabilities), is one of the most important items you can take with you.

Medicare is broken down into parts. And you’ll need to understand them before you can choose which ones you plan to take. Let’s explore the different parts of Medicare and learn how you can use them to meet your health goals.

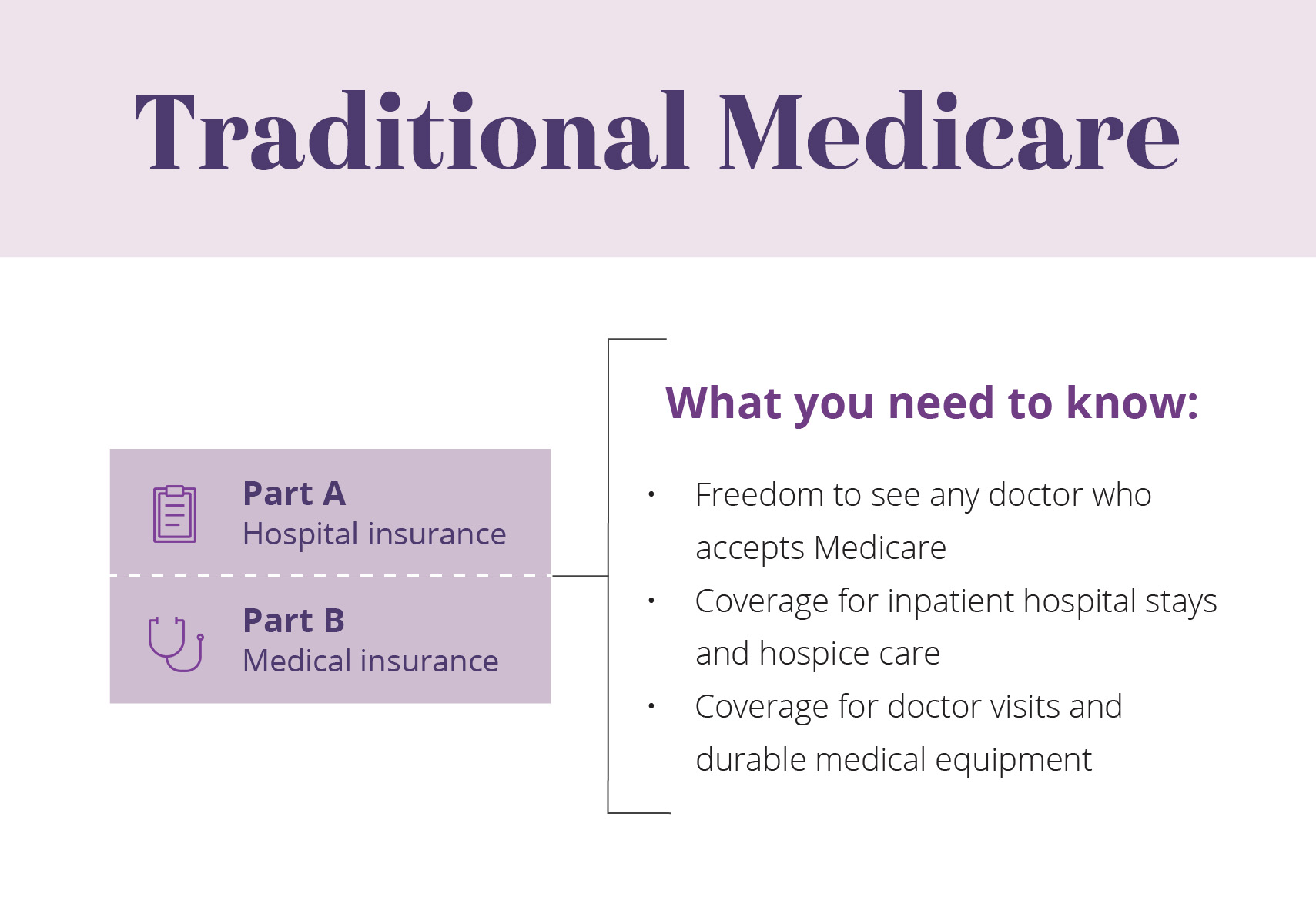

Medicare Part A — Hospital coverage

- What Medicare Part A covers: Part A covers expenses associated with hospital care. It includes coverage for services like nursing care and hospital stays. It also covers some hospital-related care that takes place outside a hospital setting. For example, skilled nursing care after you leave the hospital.

- What Medicare Part A costs: You generally won’t have to pay a monthly premium for Medicare Part A if you or your spouse paid Medicare payroll taxes for 40 quarters or more. But you do need to pay deductibles before Medicare will cover any hospitalization costs.

Medicare Part B — Covering your doctor visits and beyond

- What Medicare Part B covers:

- Doctor visits

- Durable medical equipment

- Outpatient procedures (even if they occur at a hospital)

- Lab services

- Other testing

- Additional services

- What Medicare Part B costs: Most people need to pay a monthly premium to maintain their Part B coverage. You also need to pay a deductible before Part B begins paying for services. And if your income exceeds a certain amount, you pay the premium plus an extra charge. This is called an Income Related Monthly Adjustment Amount (IRMAA).

Medicare Part A + Medicare Part B = Traditional Medicare

Part B complements your Part A coverage to provide coverage both in and out of the hospital. In fact, Part A and Part B were the first parts of Medicare created by the government. This is why the two parts together are often referred to as “Traditional Medicare.” Additionally, most people who do not have additional coverage through a group plan (such as those offered by employers) generally sign up for Parts A and B at the same time.

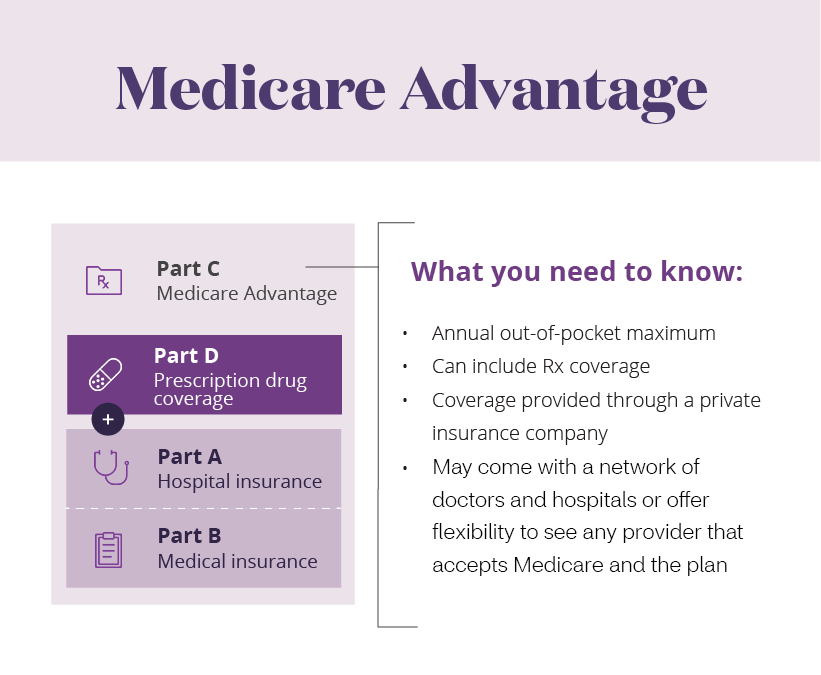

Medicare Part C — Combining your coverage

Medicare Part C is also known as Medicare Advantage. It’s made up of plans approved by Medicare that are offered through private insurance companies. Before enrolling in a Medicare Advantage plan, you’ll need to sign up for both Part A and Part B. You can then choose a Medicare Advantage plan that’s right for you. This means that to get a Medicare Advantage plan, you have to sign up directly with the private insurer that offers the plan you want. But you can only sign up after you’ve enrolled in Parts A and B.

- What Medicare Part C covers: All Medicare Part C, or Medicare Advantage, plans cover everything Traditional Medicare covers. But Medicare Advantage plans can also cover more. They include Medicare Part A, Part B and may include Part D prescription drug coverage.

- What Medicare Part C costs: Once you have a Medicare Advantage plan, you continue to pay a monthly Part B premium to Medicare. In some cases, you may also pay an additional premium to the insurance company that provides your Part C plan. The amount of the premium varies among Medicare Advantage plans. You may also have other out-of-pocket costs, including copayments, coinsurance and deductibles. Medicare Advantage puts a limit on the amount you pay for your covered medical care in a given year. This limit is known as an out-of-pocket maximum. Traditional Medicare does not have this feature.

Medicare Advantage plans can offer additional benefits because the plans are made up of networks of health care providers. And these networks can be more efficient in delivering care. As a result, they reduce overall health care costs. Some Medicare Advantage plans require you to use their network of providers. Others allow you to go to out-of-network providers, sometimes for a higher cost.

As you explore your options, consider whether you want to continue seeing your current doctors when you make the switch to Medicare. If you do, find out if they accept Medicare and are open to new patients.

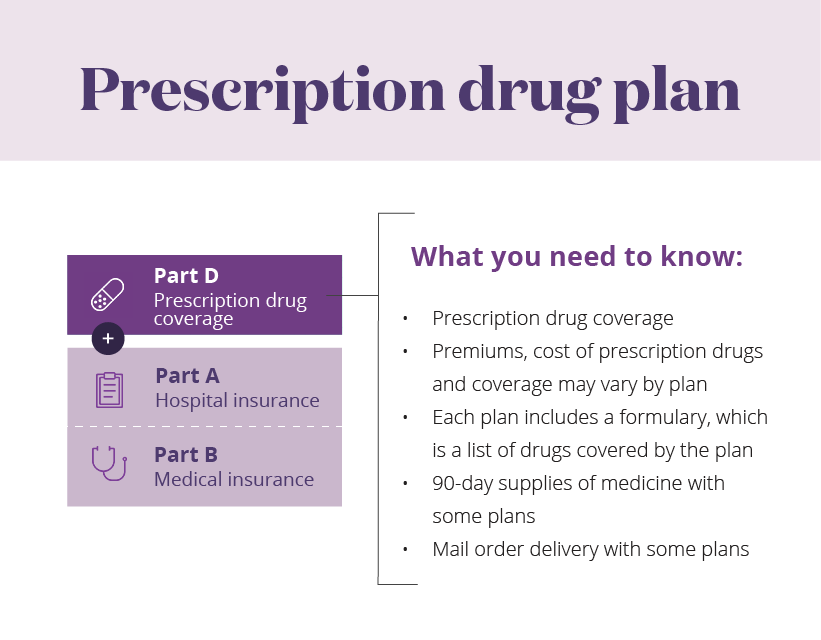

Medicare Part D — Your prescription drug plan*

Like Medicare Advantage, Part D plans are offered by private insurance companies that are approved by Medicare. Prescription drug benefits are often included as part of Medicare Advantage plans. However, if you choose to enroll in Traditional Medicare, you can add prescription drug coverage to your Traditional Medicare coverage. You can do this by purchasing a stand-alone Part D plan from a private insurer.

- What Medicare Part D covers: Part D covers prescription drugs. Every Medicare prescription drug plan has a list of drugs that it agrees to cover. This list is known as a formulary. When you research a plan, check your list of medications against the prescription drugs in your plan’s formulary.

- What Medicare Part D costs: Depending on the Part D plan you choose, you usually pay a monthly premium and sometimes a deductible. If your income exceeds a certain amount, you’re also responsible for an extra monthly charge. It’s called a Part D Income Related Monthly Adjustment Amount (IRMAA), and it’s on top of your premium. In addition, you’re responsible for out-of-pocket costs for your drugs. But keep in mind each plan varies in the cost of premiums, the prices of drugs and the list of drugs covered.

*Note: The Medicare Part D and prescription drug information above is educational only. Check your benefit documents for details about what is specifically covered under your plan.

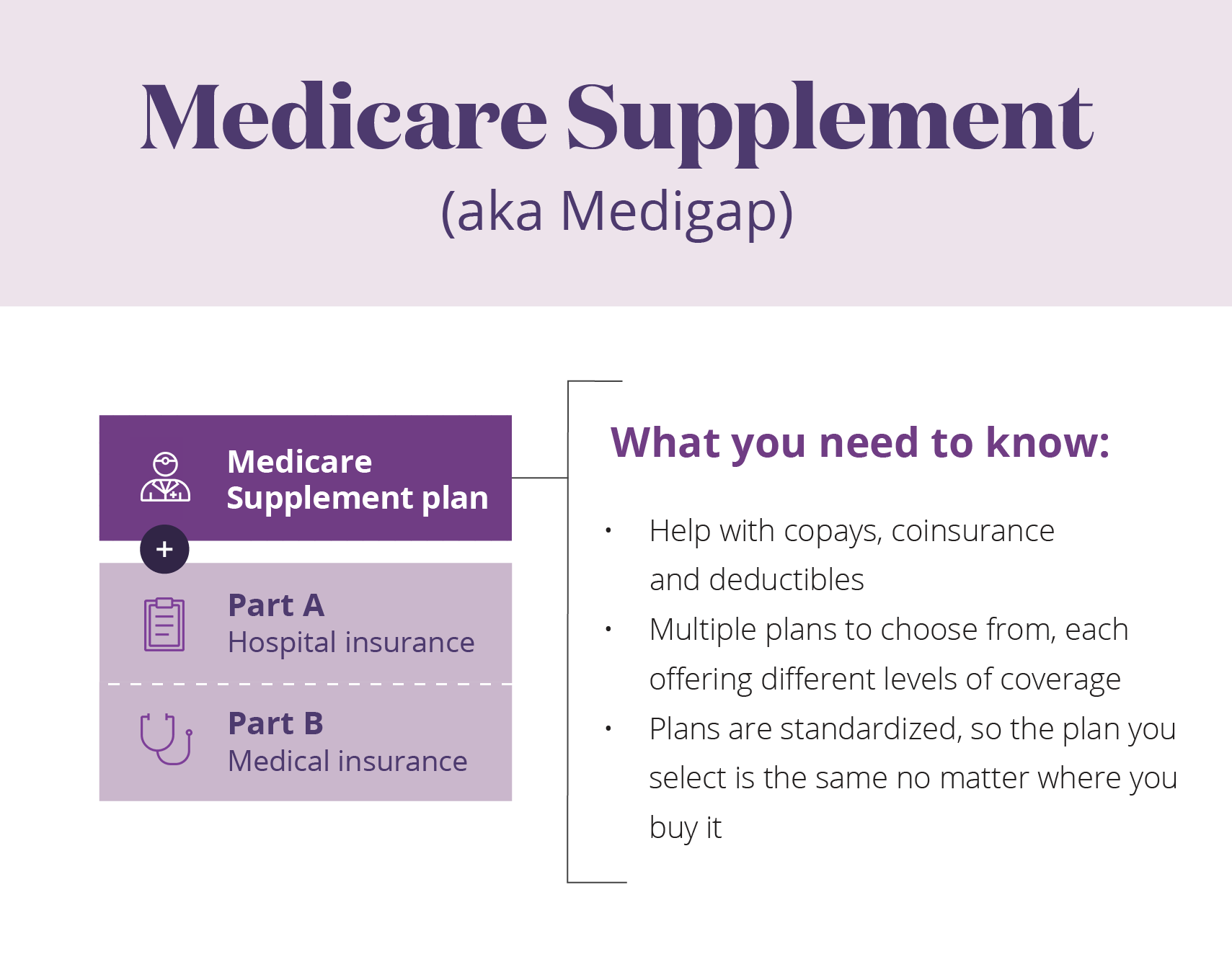

Medicare Supplement plans — Additional coverage for Traditional Medicare’s out-of-pocket costs

Medicare Supplement plans are sometimes called Medigap plans. They’re sold by private insurance companies, just like Medicare Advantage and Medicare Part D prescription drug plans.

- What Medicare Supplement plans cover: Medicare Supplement plans help manage some out-of-pocket costs that Traditional Medicare doesn’t cover, including copayments and deductibles. That means Medicare Supplement plans are only available to people who are covered by Traditional Medicare. If you opt for a Medicare Advantage plan, you’re not eligible to buy a Medicare Supplement plan.

- What Medicare Supplement plans cost: Medicare Supplement plans charge a monthly premium. The cost of the premium varies with the plan.

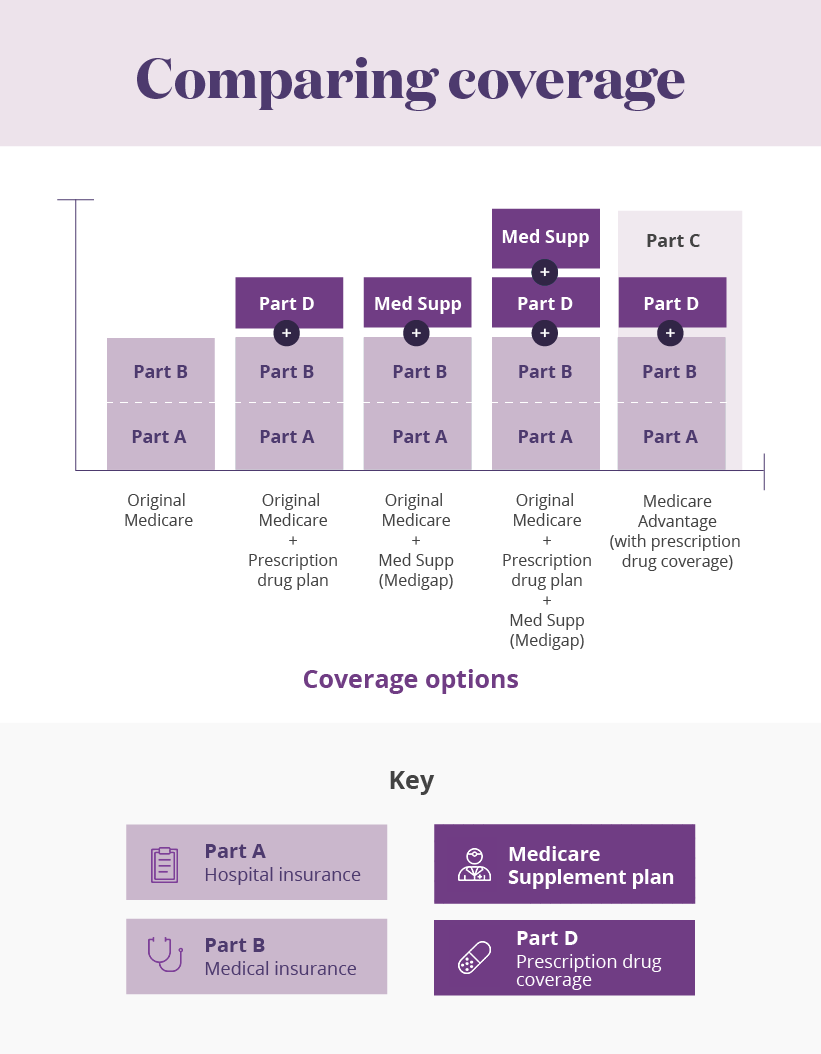

Print Comparing Coverage infographic.

See Evidence of Coverage for a complete description of plan benefits, exclusions, limitations and conditions of coverage. Plan features and availability may vary by service area. Participating physicians, hospitals and other health care providers are independent contractors and are neither agents nor employees of Aetna. The availability of any particular provider cannot be guaranteed, and provider network composition is subject to change. The formulary, provider and/or pharmacy network may change at any time. You will receive notice when necessary. Out-of-network/non-contracted providers are under no obligation to treat Aetna members, except in emergency situations. Please call our customer service number or see your Evidence of Coverage for more information, including the cost-sharing that applies to out-of-network services.

About the author

Mark Pabst has worked as a writer and researcher in the health care field for almost two decades. When not writing about health he tries to stay healthy through activities like hiking, climbing and paddling in the far flung corners of his native state of California. However, despite his best efforts he still has a few unhealthy habits he can’t shake, most notably a weakness for jelly donuts.