Unpacking Medicare Part C: Could a Medicare Advantage plan be right for you?

Medicare Advantage plans offer 3 advantages: cost, coverage and convenience. Learn more and see if they are right for you.

There’s a lot to be said for being able to get everything you need under one roof. For starters, it’s more convenient. That’s the principle behind Medicare Advantage: a unique part of Medicare that pulls together many benefits, care options and costs into one plan.

What is Medicare Advantage?

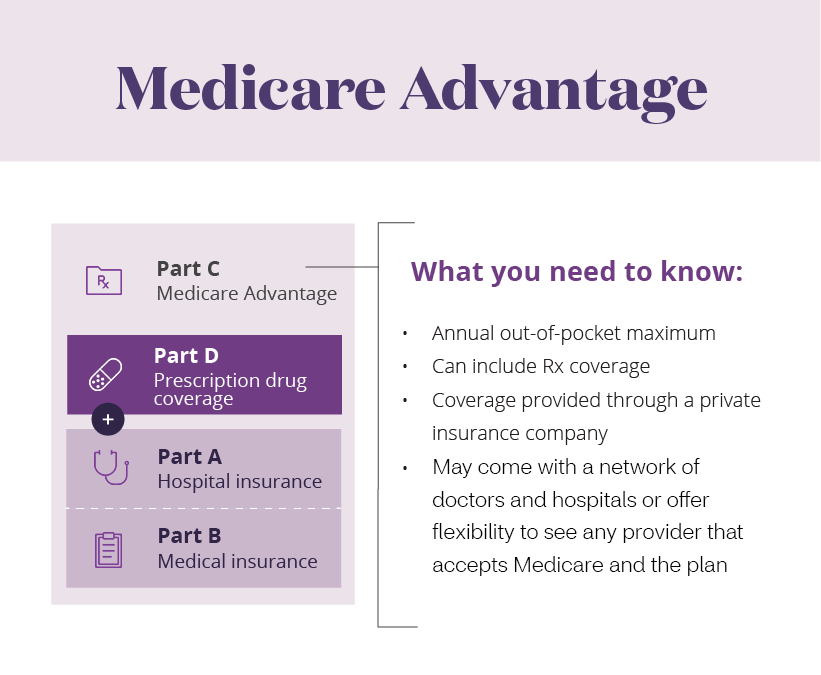

Medicare Advantage plans are provided by private insurance companies approved by Medicare. These plans are also known as Medicare Part C. By law, every Medicare Advantage plan must include coverage for everything that Medicare Parts A and B, often called Traditional Medicare, cover. That means they include the same hospital and outpatient services. But Medicare Advantage plans may also cover more than Traditional Medicare.

Medicare Advantage is a unique part of Medicare that pulls together many benefits, care options and costs into one plan.

What does Medicare Advantage cover?

While plans vary, some additional benefits of Medicare Advantage plans include:

- Health and wellness programs

- Telehealth services

- Vision and hearing reimbursement

Some plans also include prescription drug coverage.

So, a comprehensive Medicare Advantage plan can come with all the coverage you get with Medicare Parts A, B and D. The additional coverage beyond what is offered by the other parts of Medicare is like the icing on the Medicare cake.

How do Medicare Advantage plans provide additional benefits at a reasonable price?

Medicare Advantage plans harness the power of care networks. These are groups of doctors and other health care professionals who contract with your plan. These networks help keep costs down. It also means your care may not be covered if you go outside your plan’s network. So make sure your favorite doctors accept Medicare and the Aetna plan.

It’s also important to remember that not all plans are alike. Two of the most common types are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs).

What’s the difference between an HMO and PPO plan?

Medicare Advantage HMO plans generally require you to stay within the network. And you may need to get referrals to see specialists. But, there are exceptions for emergency care or out-of-area urgent care.

Medicare Advantage PPO plans provide more flexibility to see doctors without a referral. You can use any provider who accepts Medicare and agrees to accept the Aetna plan before treating you.

Traveling with Medicare Advantage

If you travel regularly, make sure you’ll be covered if you need care while on the road. Medicare Advantage plans tend to have a service area. This means that particular plans are only available to people who live in specific areas. And networks of health care professionals may be restricted to the plan’s geographic area. But there are exceptions.

Some Medicare Advantage plans focus on more than one region. So if you summer in New England but winter in Florida, there might be a plan out there for you. Be sure to shop around to make sure there are in-network doctors in both places. Just because you travel regularly doesn’t necessarily mean Medicare Advantage isn’t for you.

Some perks of MA plans

Lifestyle coaching programs: talk with a health coach about how to reach goals like managing stress better, quitting smoking or improving your diet.

A multidisciplinary care management team: connect to the right resources, coordinate your benefits and ensure better orchestration of care.

Online tools and resources: look up guides to make healthy decisions and manage conditions.

The three C’s of Medicare Advantage: cost, coverage and convenience

Medicare Advantage brings together the benefits of other parts of Medicare (plus a few added benefits) under a single plan. So it helps you with the three C’s: cost, coverage and convenience.

About the author

Mark Pabst has worked as a writer and researcher in the health care field for almost two decades. When not writing about health he tries to stay healthy through activities like hiking, climbing and paddling in the far flung corners of his native state of California. However, despite his best efforts he still has a few unhealthy habits he can’t shake, most notably a weakness for jelly donuts.

*Note: The Medicare Part D and prescription drug information in this section is educational only. Check your benefit documents for details about what is specifically covered under your plan.